Large-scale capital, sophisticated trading strategies, and high-end risk management tools are some of the key things that institutional investors are rapidly bringing into the global cryptocurrency market. Hedge funds, asset managers, pension funds, and multinational corporations are some institutional investors increasingly diving into digital assets because of the high returns, strong liquidity, and rise of regulated crypto exchanges in 2025. Understanding how institutional investors trade cryptocurrency is essential for traders who want to follow proven, profitable, and sustainable strategies.

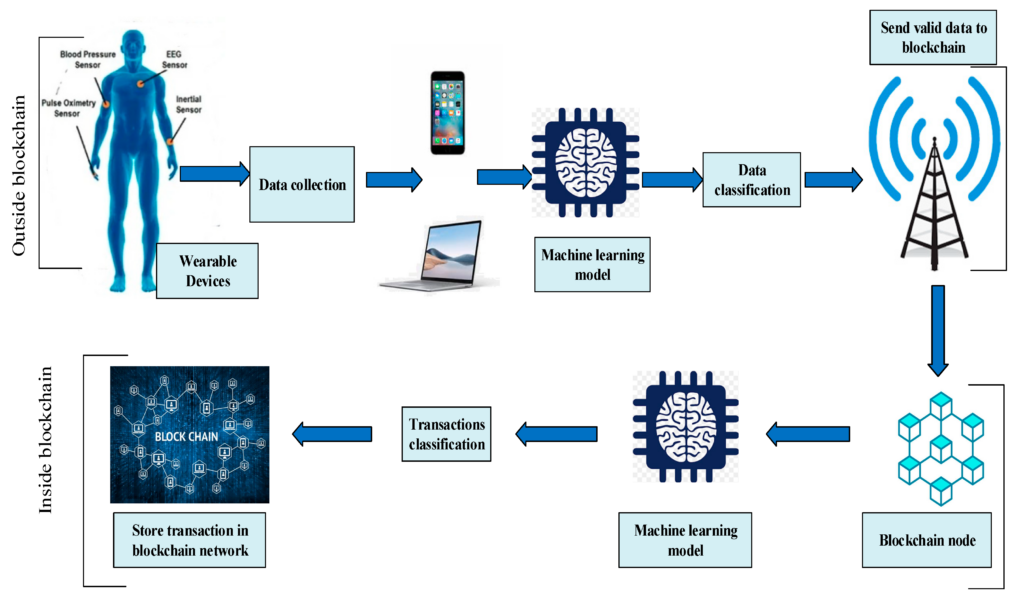

One of the key reasons why institutions dominate crypto trading is data-driven decision-making. While retail traders make their decisions based on emotion or some basic indicators, institutions apply quantitative models, market analytics, on-chain metrics, and proprietary algorithms to detect trading opportunities. These tools help identify whale activity, liquidity flows, price manipulation patterns, and early trends before they become mainstream. As a result, institutional trading behavior often shapes overall market movements.

Institutions also heavily rely on algorithmic trading systems built for high-speed, low-cost trade execution. Such systems utilize automated bots to track price fluctuations, predict trends, and execute trades on multiple exchanges at once. Algorithmic trading cuts down on human error and allows institutions to capitalize on arbitrage, market inefficiencies, and short-term volatility. This kind of approach greatly increases trading volume and attracts high CPM and CPC keywords around algorithmic crypto trading.

Another major advantage institutional investors possess is trading through OTC desks. Over-the-counter platforms afford institutions the ability to buy or sell large amounts of cryptocurrency without price slippage, thereby limiting market impact and also giving them privacy. Major financial institutions today own their own OTC desks, offering pools for high-value trade liquidity and settlement services-something retail investors would hardly find access to.

They also use derivatives trading, such as crypto futures, options, and perpetual contracts, for hedging and amplifying the potential for profits. Via derivatives, they can speculate on the price movement without holding the underlying asset, or even get income from the premiums, or protect their portfolio from the most turbulent times in the market. These are among the highest CPC topics in crypto advertising due to their complexity and profitability.

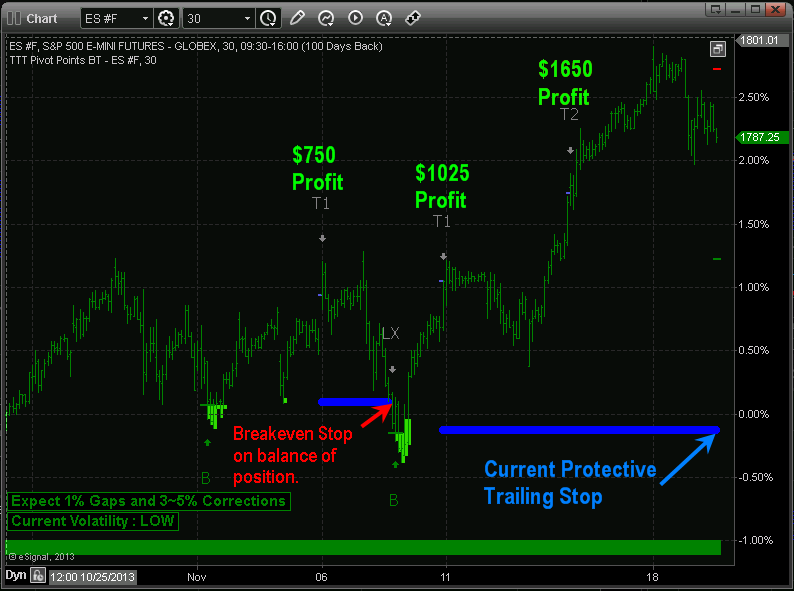

The other cornerstone of institutional crypto trading is risk management. Institutions implement severe portfolio diversification, where capital is divided among Bitcoin, Ethereum, stablecoins, and promising altcoins while balancing the risk with automated stop-loss systems and hedging strategies. Large-scale crypto holdings are safeguarded from theft or hacking thanks to advanced custodial solutions that include HSMs and institutional-grade wallets.

Institutions also watch global regulations closely because legal clarity is an important factor for liquidity and long-term profitability. Countries like the U.S., EU, Singapore, and UAE that are supportive of clear frameworks in digital assets tend to attract more institutional investors. Compliance with KYC, AML, and securities regulations builds trust among stakeholders and advertisers in high-value financial sectors, while ensuring safety on legal grounds.

In addition, many institutional investors participate in staking, yield farming, and provision of liquidity for passive income generation. These methods of income generation provide stable returns that complement active trading strategies. Their involvement increases market liquidity and supports the development of more advanced blockchain-based financial products.

Another powerful strategy employed by the institutions involves sentiment analysis, whereby social media, news sentiment, and community behavior are analyzed. With the use of AI-powered sentiment tools, the institutions have the ability to predict how public emotions impact market volatility. This allows them to go in and out of trades before retail investors react and gives them a strong competitive advantage.

Lastly, collaboration with blockchain analytics firms helps institutions detect fraud, identify suspicious wallets, and monitor capital movements-all assisting in making smarter investment decisions and furthering long-term growth in regulated crypto markets.

Conclusion Therefore, institutional investors trade cryptocurrencies, make use of advanced tools, employ automated algorithms, perform on-chain analytics, use OTC desks, and put in place robust risk management strategies. Their involvement increases liquidity, stability, and transparency in crypto markets around the world. To retail traders, understanding how institutions operate can open up opportunities, cut losses, and pave the way for better decision-making. With increased adoption by institutions in 2025, their trading behaviors will make the difference in how digital assets will shape up in the future.